When using the CyberStore tax settings for Commodity Code and Jurisdiction, additional computation logic has been added to allow the management of tax exemption for the order line based certain criteria on the Customer in SYSPRO.

Console Updates for Tax Rule Exemption (#10040)

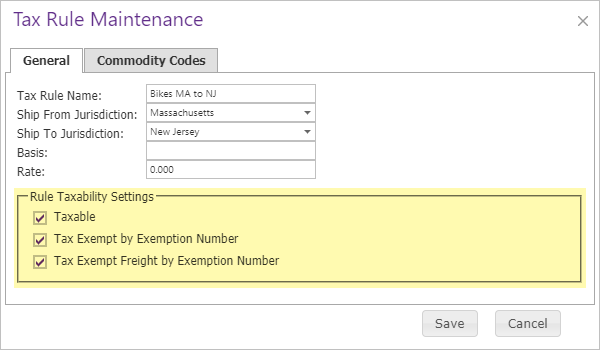

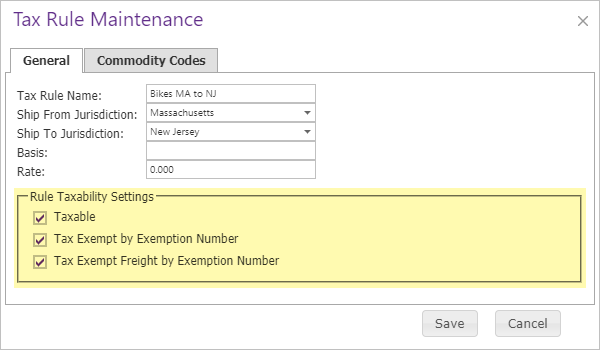

When setting up line-level tax rules in CyberStore, options for managing tax exemption can now be setup as well.

This feature allows a user to set a rule so that it may be taxable by default, but not taxable when a Customer is setup in SYSPRO with a value in their tax exemption number field.

In addition a rule may be able to influence the taxable or not-taxable nature of the freight line of the order.

Alter Business Logic and Processing for Tax Rule Based Exemption (#10039)

The tax rule processing business logic in CyberStore has been extended as follows:

- When a tax rule configured for "Tax Exempt by Tax Exemption Number" setting,

- and the Customer has any non-blank value in the tax exemption number field in SYSPRO,

- and the item being evaluated falls into one of the tax rule's commodity codes,

- then the line will be set to non taxable even if another tax rule for the same line dictates it is taxable.

- When a tax rule is configured with the "Tax Exempt Freight by Exemption Number" setting,

- and the Customer has any non-blank value in the tax exemption number field in SYSPRO,

- and the item being evaluated falls into one of the tax rule's commodity codes,

- then the order's freight line will be non taxable, even if there is only a single item that qualifies in the entire order.

See Also