CyberStore allows you to set line Item taxability. However, in order for this function to work properly when your SYSPRO Tax System is set to USA AVP, there are a few modifications that you need to make in SYSPRO.

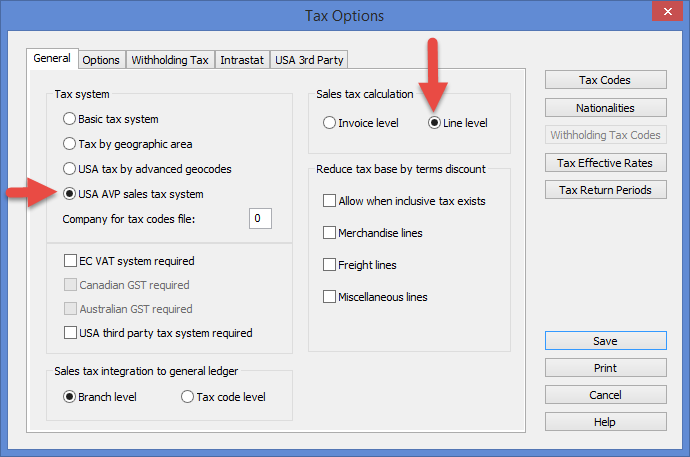

To set the tax calculation at the line level, go to SYSPRO's "Tax Options" Maintenance screen. Under the Generaltab, find the "Sales tax calculation" section and select "Line level." If you do not select this in SYSPRO, you will not be able to use this tax feature in CyberStore.

See an example of this setup below:

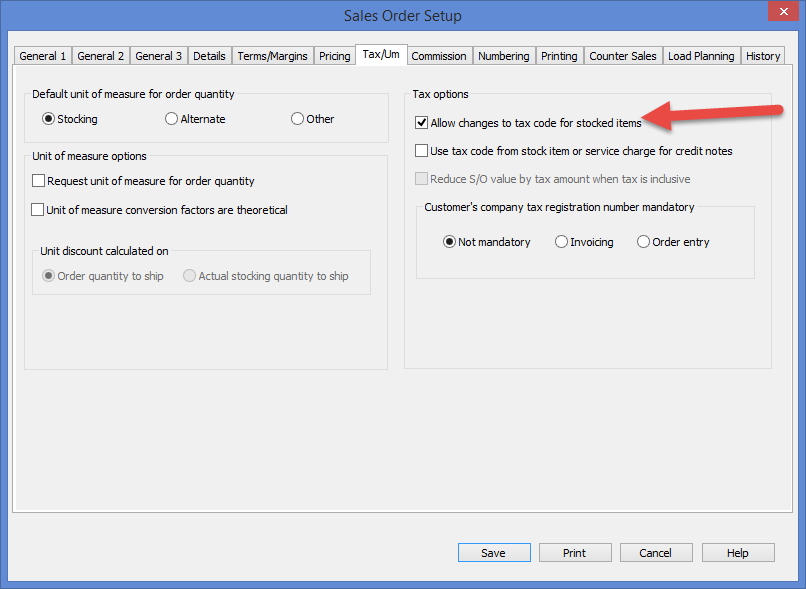

Similar to the method above, you must make changes in SYSPRO to use the line Item tax override feature in CyberStore. In SYSPRO, go to "Sales Order Setup." Navigate to the Tax/Umtab. Under "Tax options," select "Allow changes to tax code for stocked Items."

See an example of this setup below:

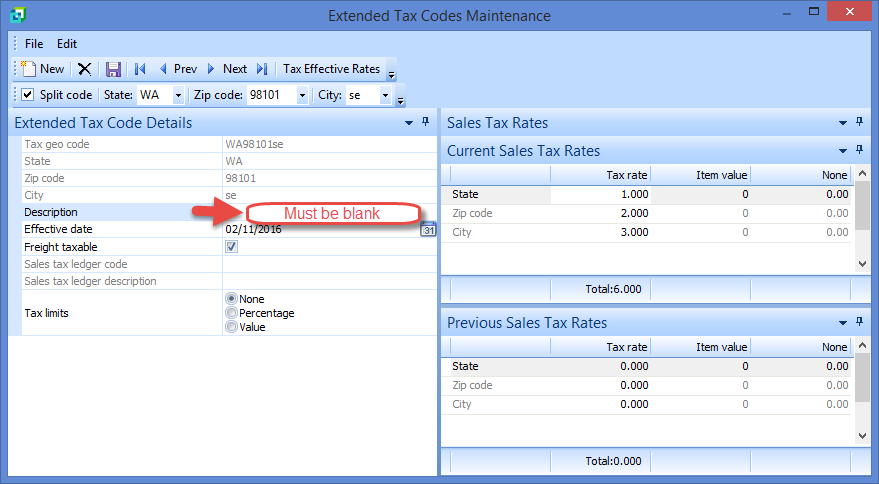

To avoid processing issues, go to SYSPRO's "Extended Tax Codes Maintenance" screen. Ensure that the "Description" field is empty.

See the example below: