There are 2 taxes in Canada:

1. Provincial Sales Tax (PST) - this varies from 0% in some provinces to 10% in other provinces.

2. Goods and Services Tax (GST) - GST is 5% for all provinces with the exception of Ontario, New Brunswick, Nova Scotia, Newfoundland and Labrador, and Prince Edward Island.

These 5 provinces combined their provincial sales tax with the GST to create a single Harmonized Sales Tax (HST). All but Ontario (13%), have a HST of 15%. HST is treated the same way as GST.

The amount of tax to be charged depends on the province of your customer.

The following sources contain a detailed list of the PST amounts for each Canadian province:

http://www.taxtips.ca/provincial_sales_tax.htm

http://sbinfocanada.about.com/cs/taxinfo/g/pst.htm

http://sbinfocanada.about.com/od/pst/

|

Province/Territory |

GST |

PST |

Web Site |

|---|---|---|---|

|

British Columbia |

5% |

7% |

|

|

Alberta |

5% |

no PST |

n/a |

|

Saskatchewan |

5% |

6% |

|

|

Manitoba |

5% |

8% |

|

|

Ontario |

13% HST |

- |

(Retail sales tax still applies to certain insurance and private sales of specified vehicles) |

|

5% |

9.975% |

Quebec Basic Rules for GST/HST and QST Quebec Consumption Taxes - for businesses |

|

|

Newfoundland and Labrador |

15% HST |

- |

|

|

Nova Scotia |

15% HST |

- |

|

|

New Brunswick |

15% HST |

- |

|

|

Prince Edward Island |

15% HST |

- |

|

|

Northwest Territories |

5% |

no PST |

n/a |

|

Nunavut |

5% |

no PST |

n/a |

|

Yukon |

5% |

no PST |

n/a |

In order to access Canadian GST in SYSPRO, the nationality code must be set to CAN (Canada). This can be done globally for all companies or individually at the company level.

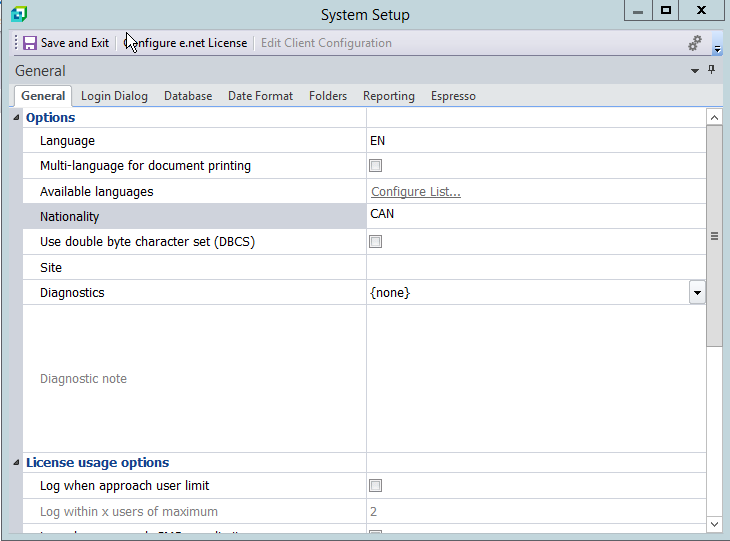

For global nationality setting:

Setup > System Setup > General tab. Under "Options," set "Nationality" = CAN

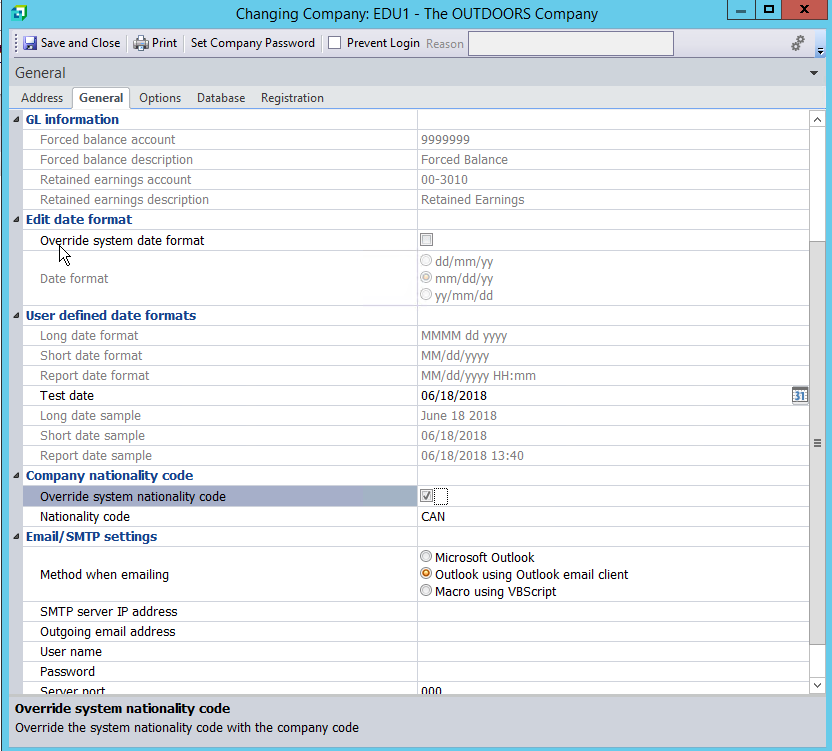

For company-specific nationality setting:

Setup > Company Setup > General tab > Under "Company nationality code," select "Override system nationality code" and set "Nationality code" = CAN

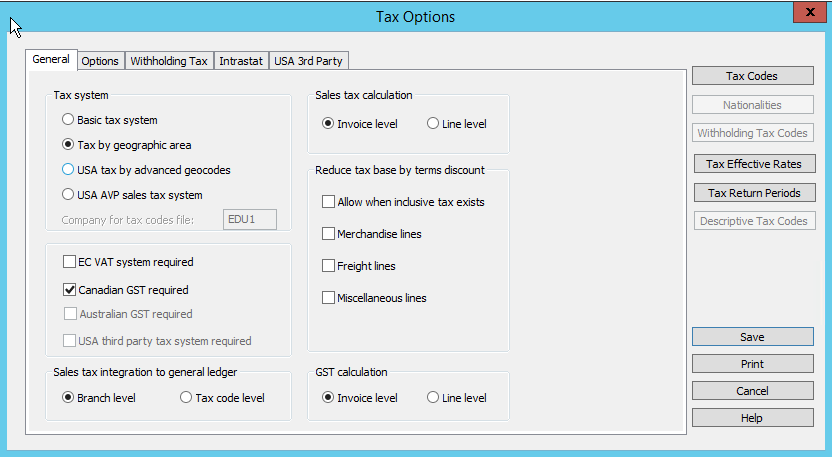

Once the nationality code is set to CAN, the "Canadian GST required" field will be available under Setup > Tax Options > General tab - Select this to activate GST.

The Tax system most commonly used is "Tax by geographic area" as the sales tax (PST) varies from province to province.

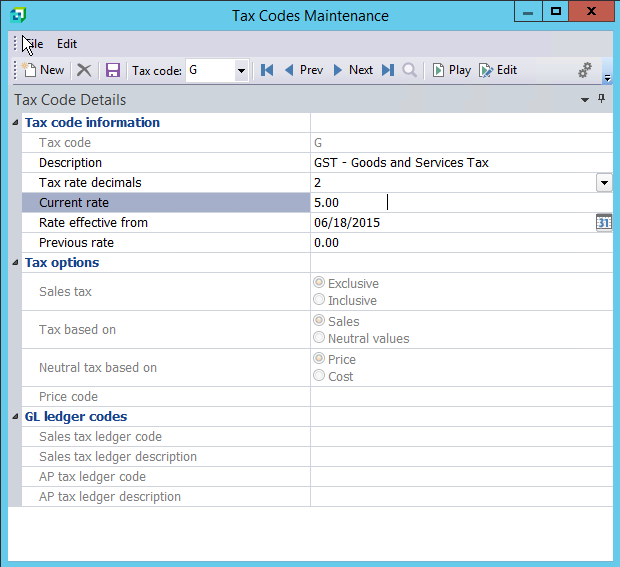

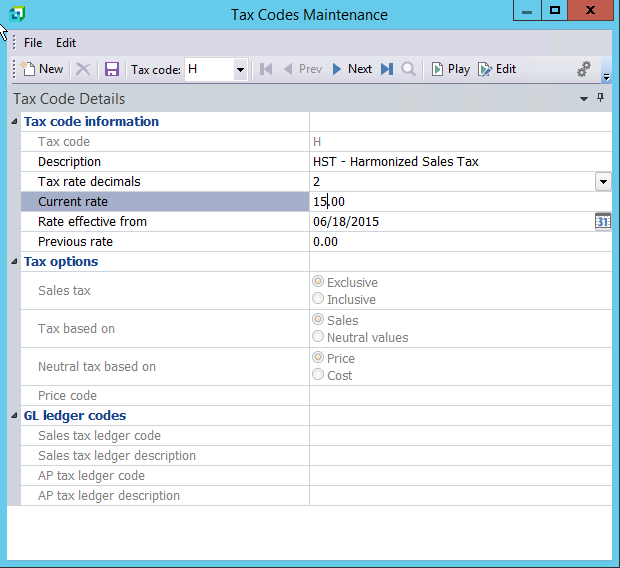

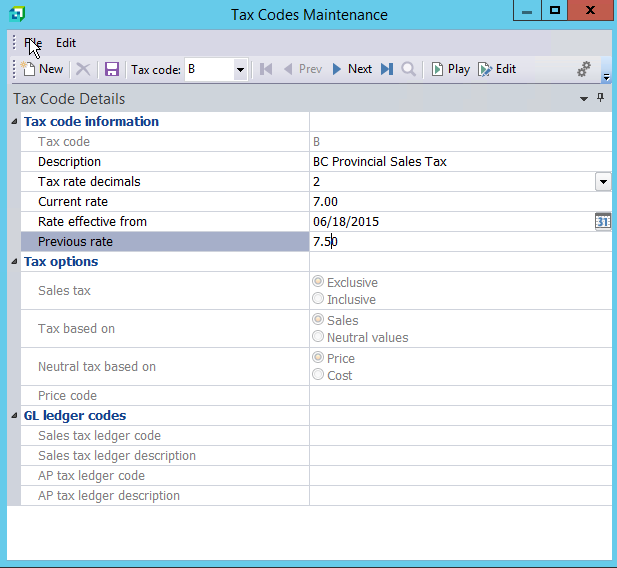

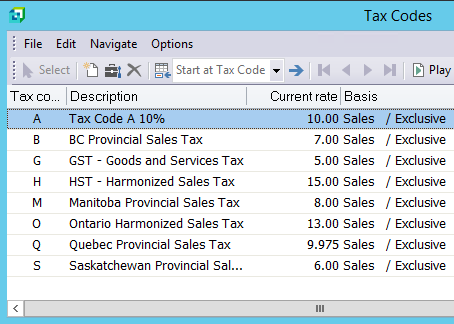

Under Setup > Tax Options >Tax Codes, there are a few tax codes you’ll need to setup:

1. GST - Goods and Services Tax - Generally, tax code G is used.

2. HST - Harmonized Sales Tax - Generally, tax code H is used.

3. PST - Provincial Sales Tax - A separate provincial sales tax code should be created for each province.

List of Tax codes:

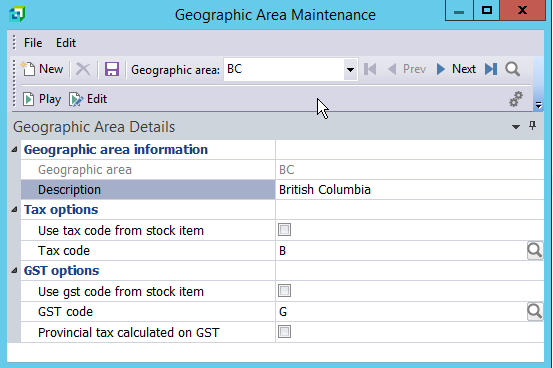

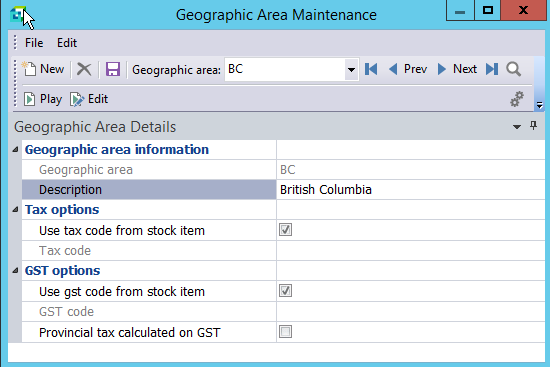

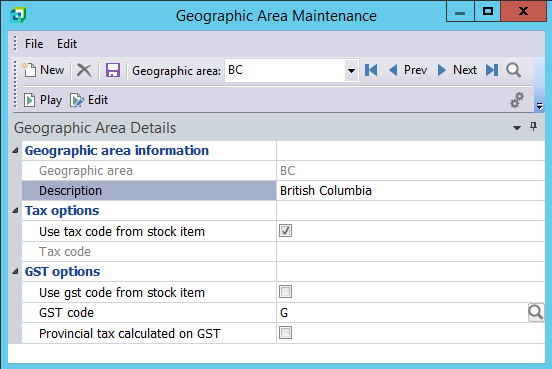

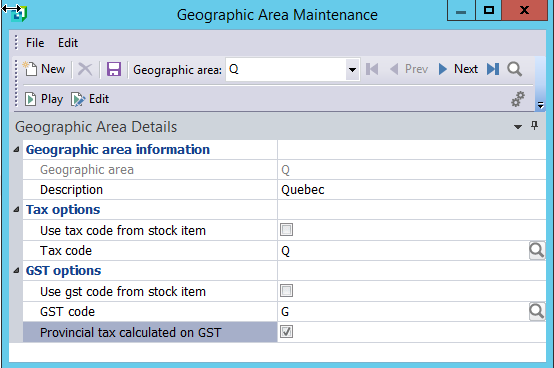

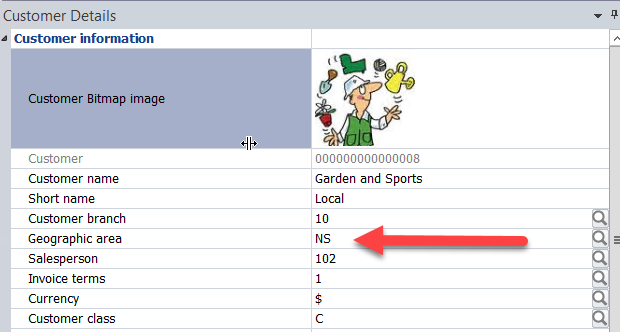

Next, you’ll need to go to Geographic area (Accounts Receivables > Setup > Geographic area) and do as follows:

1. Create a Geographic area for each province

2. Define the sales tax (PST) and GST codes for each geographic area

Under the Geographic area Tax code and GST code settings, you can either:

Either method is acceptable depending on the nature of the business and/or items which are taxable.

eg. PST and GST tax codes defined against each geographic area:

eg. PST and GST tax codes to be taken from stock code master:

eg. PST to be taken from stock code master and GST defined against each geographic area:

Note: The "Provincial tax calculated on GST" option is used for provinces where the PST is calculated on top of GST.

Their geographic area will be defined as follows:

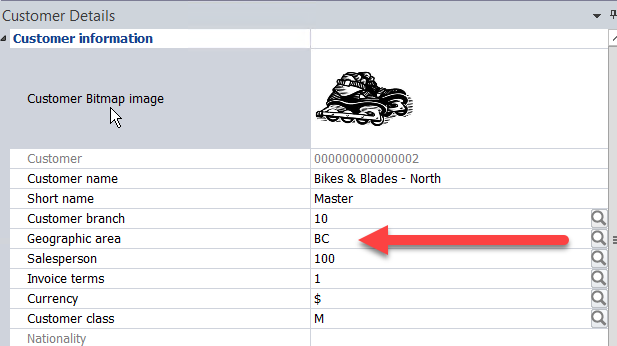

Next, we need to define the following against each customer in SYSPRO: (Accounts Receivable > Setup > Customers)

There could be a couple of scenarios for customer tax setup:

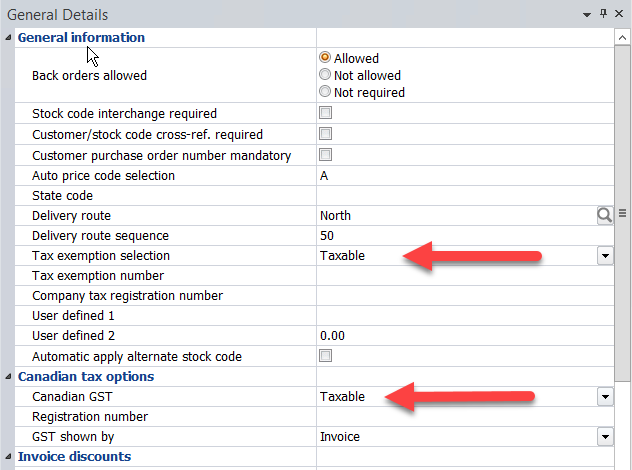

Canadian customers who are located in provinces where there is Provincial Sales Tax (PST) as well as Goods and Services Tax (GST) should have the following defined against the General Details tab:

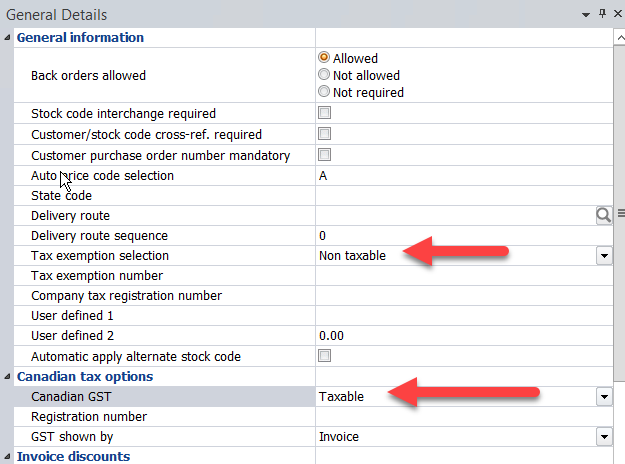

Canadian customers who reside in the 5 provinces (Ontario, New Brunswick, Nova Scotia, Newfoundland and Labrador, and Prince Edward Island) where there is no PST, but only a Harmonized Sales Tax (HST), OR

Canadian customers who reside in provinces where PST is 0% and only GST is charged, should have the following defined:

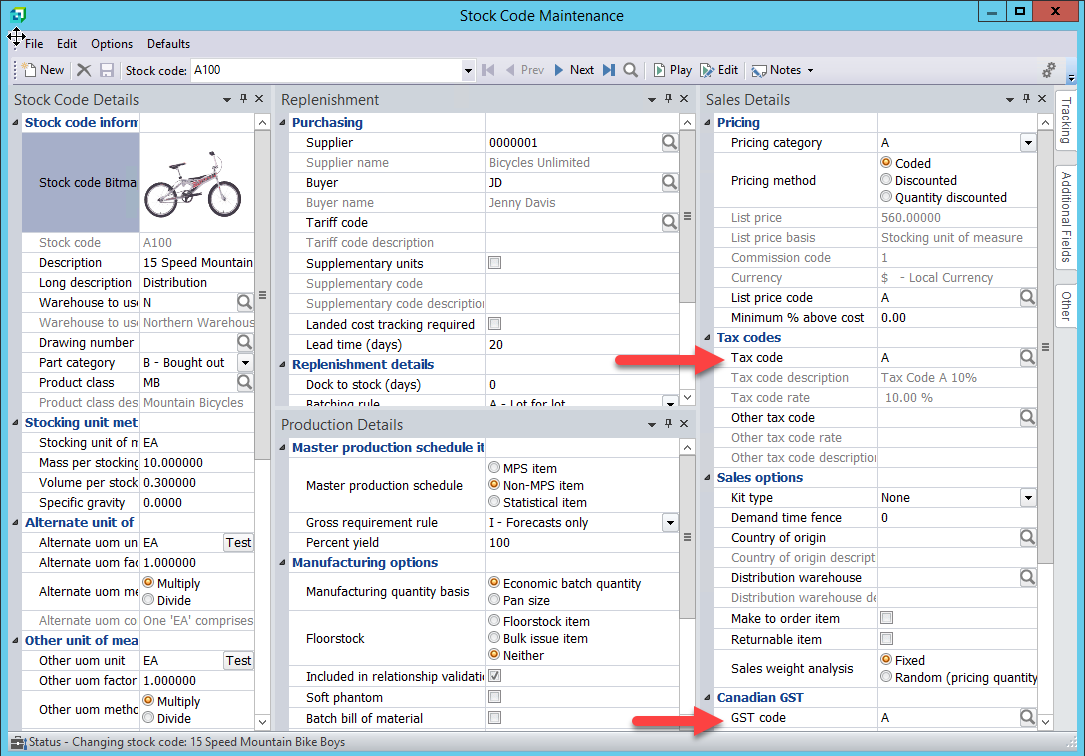

In addition, against the stock code master (Inventory > Setup > Stock codes > Sales tab), one can also define a "Tax code" and a "Canadian GST code."

By default, when a new stock code is created, SYSPRO automatically populates the "Tax code" and the "Canadian GST code" fields with Tax code A.

NOTE: If using above tax setup options, the stock code master is the last place SYSPRO will go to read tax codes (see section below: How SYSPRO reads the tax information). Therefore, if you’re not going to be using the tax code fields defined against the stock code, it is fine to leave these as default Tax code A (even if A is a non-zero tax rate).

However, there must be a valid "Tax code" and a "Canadian GST code" defined in these 2 fields, regardless of whether these fields are used (ie. these two fields cannot be left blank).

SYSPRO looks at the tax information in the following order when a sales order is entered to determine which tax code(s) to use:

1. Customer master (Accounts Receivable > Setup > Customers > Tax tab)

Taxable/Non taxable options defined for PST and GST.

2. Geographic area defined against the customer (Accounts Receivable > Setup > Customers > Basic tab > Geographic area)

From customer’s specified geographic area, SYSPRO will look at the tax code and GST code options defined against the geographic area (Accounts Receivables > Setup > Geographic area)

3. Stock Code (Inventory > Setup > Stock codes > Sales tab)

Since the option ‘Use tax code from stock code’ is selected for the geographic area of the customer, the sales order will use the tax codes defined against the Stock code > Sales tab.